- Video check deposit

- Video recordings

- E-sign

- Document exchange

- Presentations

- Screenshare & Cobrowse

- Text chat

- Customizable & automated workflows

- Emotional recognition

- Session review & Reporting

- Dynamic call routing & Warm Transfers

- Meetings (Multi-Party Video Collaboration)

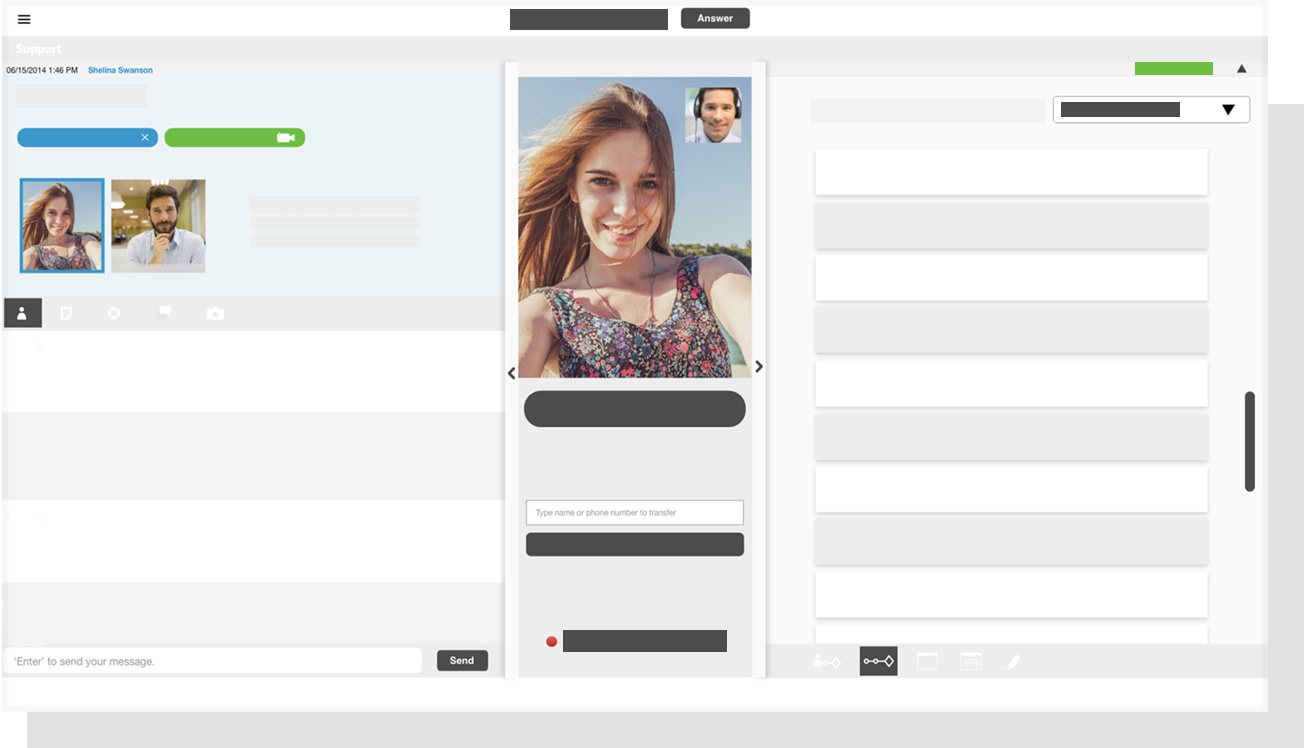

- Patented video collaboration

Introducing POPwelcome

This new feature to the POPi/o platform enables your website visitors to engage with you via chat, voice, or video to seamlessly serve your customers. Watch our video to see how this NEW feature works.

Talk to an ExpertFull-service video banking

Provide valued interactions with ease, regardless of location.

Download Our GuideMobile video banking

Provide valued interactions with ease regardless of location.

Download Implementation GuideFull-service video banking software

Conversations aren't enough. Your experts need tools to complete interactions.

What can your consumers use POPi/o to accomplish?

- New account opening & funding

- Consumer & auto loans

- Wire transfers

- Account servicing

- Mortgage education & application processes

- Investment consultations

- Signing documents

- Depositing checks

- Out of country support

- How will you deploy video banking to your consumers?

Security & integrations

Secure, and trusted by your peers

Policies that enforce processes and processes that adhere to policies is how POPi/o maintains security across production systems.

- SOC II Type II Compliant

- TLS 1.2

- 256-bit Encryption

- Separate Production | Testing | Development Environments

- Continuous system testing

Integrations that make experiences seamless

Integrations are not required to utilize video banking collaboration, but if they are for your institution here are a few of the integrations we can provide:

- Mobile SDK (Put video experts directly into your mobile banking app)

- Web SDK (Enable conversations directly from your website)

- SSO API (Single Sign On)

- Call Center ACD API

- Topaz Signature Pads

- Document Scanning