One of the byproducts of the burgeoning digital age is a sharp rise in consumer expectations for efficient and convenient experiences. Both online and in-person, consumers have grown to expect streamlined shopping experiences, flexible appointment options, and seamless cross-channel interactions.

According to Salesforce, 62% of customers say experiences with one industry influence their expectations of others, and 88% expect companies to accelerate their digital initiatives. With the rapid evolution of digital services and an increasingly internet-savvy public, the average consumer is no longer tolerant of antiquated digital experiences that are full of friction and hurdles.

Today’s Digital Challenges

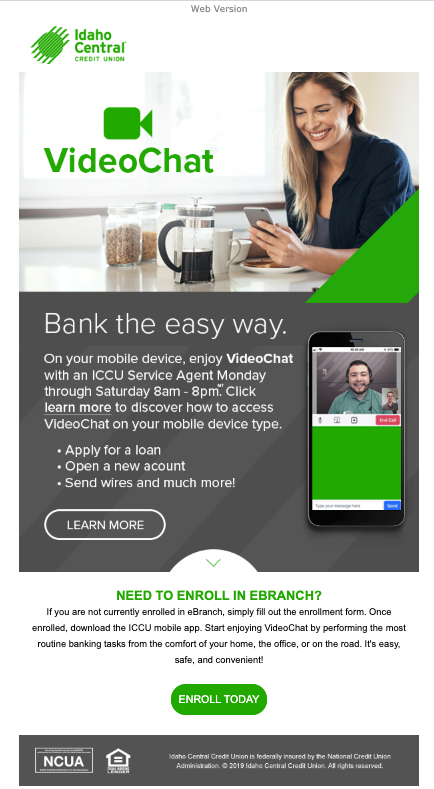

However, it’s obviously not always easy to provide this kind of broad and seamless service—especially when the financial services industry is facing major staffing shortages. Banks and credit unions are encouraged to invest in their digital experience, and yet in-branch service remains a prominent factor in the marketplace. Organizations push to engage through multiple channels, and this leaves some of them spread too thin to provide a satisfying consumer experience.

This is what makes a broad, omnichannel experience so vital in today’s market. By optimizing the customer journey and offering consumers various paths to the services they seek, you can not only secure more revenue, but can drive brand loyalty and customer satisfaction as well.

Collaborating to Create a Better Experience

A vital ingredient in this process is cross-departmental collaboration. This is the assurance that all the individual departments in an organization are working in sync to create a cohesive consumer experience.

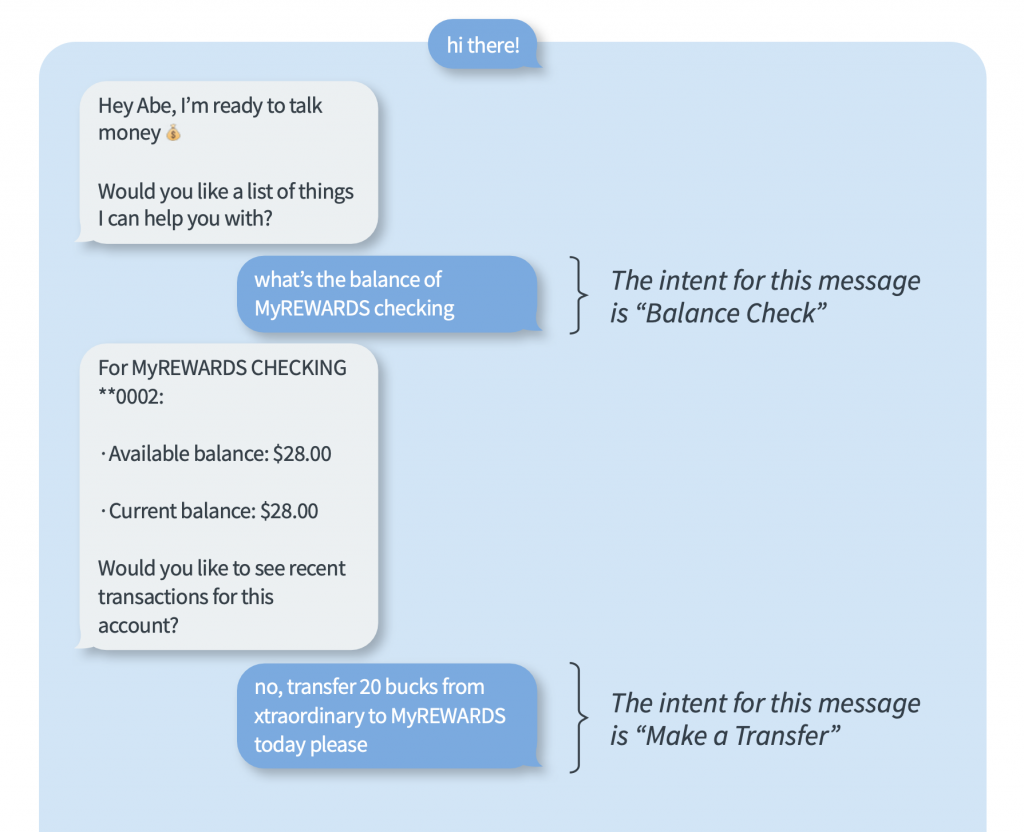

Take, for example, a community bank. With the staff of their branches, contact center, lending team, collections department, and investment department all accessible online, it follows that customers will expect to be able to move freely from one department to the next. But because these various departments are managed by different groups of people and run from different locations, the customers are sometimes faced with obstacles.

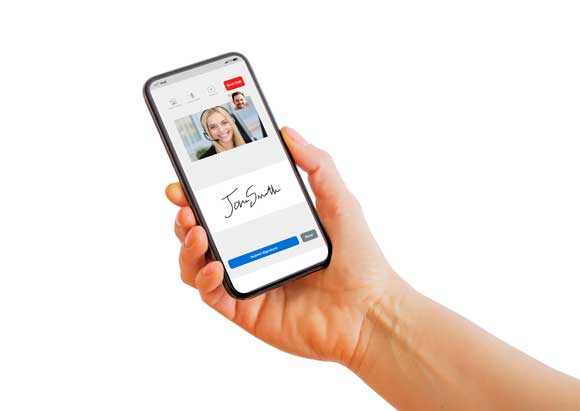

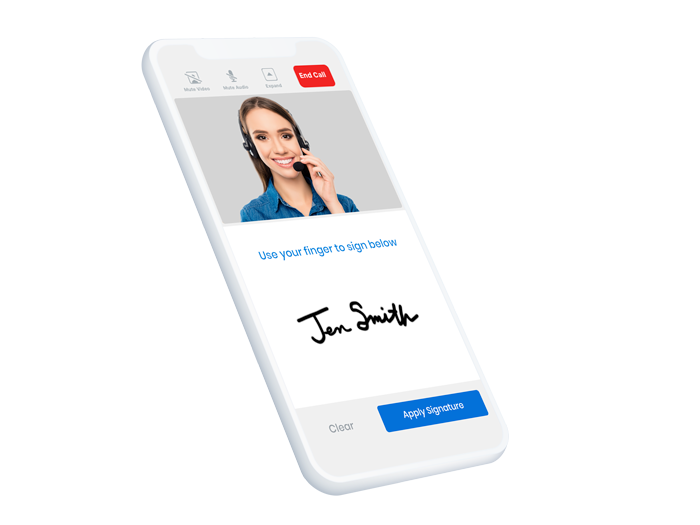

If a customer begins with a simple customer service request, and then later decides they’re curious about the bank’s auto loan offerings, their customer service agent might only be able to take them so far before transferring them to a lending officer. But when that switch happens, how efficient is it? If the customer is told to visit a branch, or to submit an application on the website, they may not follow through with their inquiry. But if the customer is simply transferred via collaborative video to meet with a lending expert, it could not only provide a more streamlined customer experience, but could also help the bank close more loans.

Experience is Everything

It’s for reasons like these that providing a satisfying digital experience has become so important. As author and customer experience expert Dan Gingiss put it, “Most companies must realize that they are no longer competing against the guy down the street or the brand that sells similar products. Instead, they’re competing with every other experience a customer has.”

With digital experiences playing an increasingly crucial role in consumer behavior, now is an ideal time to find the right Digital Communications Platform. Implementing the right digital solutions gives you the ability to build a more effective and personalized customer experience, enabling your financial institution to flourish in the digital age.

If you’re interested in learning more about the benefits of our unique Digital Communications Platform, schedule some time to speak with one of our experts here!

Looking to the Future

Looking to the Future