PCSB Bank has already won Christmas.

PCSB Bank has already won Christmas.

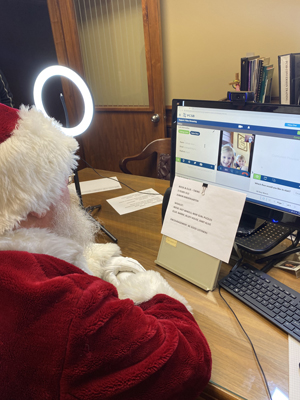

The leaders of this $1.5 billion financial institution in Clarinda, Iowa, were crushed to learn that officials had canceled this year’s community Santa House. The cancellation left no place for local kids to meet Santa, share their wish list, and pose for a photo.

Even with social distancing and frequent photoshoot wipe downs, COVID-19 has turned Santa House into a risky spreader event. While the decision made sense, CEO James Johnson felt like he had to do something. The bank couldn’t let local kids miss birthdays, graduations, summer with friends, school, trick or treating, and Santa. It was just too much.

PCSB and his team brainstormed ways the bank could help bring Santa Claus to town. The answer was our video banking.

PCSB is offering free video visits with Santa to local children using its video banking channel, which is available to customers through PCSB’s website and mobile app. The 10-minutes video chats are by appointment only. PCSB is making Santa available to both customers and non-customers. Parents can schedule visits for kids by calling the bank or filling out an online form that provides the jolly ol’ elf with important personal information that makes the moment magical.

I think this is such a great idea because it’s not only good for local kids and the community, it’s good for the bank’s bottom line, too. Here are four benefits, for starters:

Joy for local children. Sure, we love to achieve career success, but real leaders get even more fulfillment out of using their resources and influence for the greater good. They couldn’t have picked a better year to do this!

Joy for local children. Sure, we love to achieve career success, but real leaders get even more fulfillment out of using their resources and influence for the greater good. They couldn’t have picked a better year to do this!- Corporate citizen goodwill. Community financial institutions are the foundation of healthy communities. By making Santa available to kids for free at a time when families are struggling financially and feel unsure about the future, the bank is providing a sense of normalcy and hope for the future.

- Video banking demonstration. I can’t think of a better way to motivate people to try video banking than a visit with Santa. Customers are often impressed with how easy video banking is to use and return to use the channel again and again.

- New Customers. All FI marketers know the key to getting new business is being top of mind when the customer is ready to buy. Not only does Santa raise awareness and the bank’s reputation, it cleverly showcases new technology that sets PCSB apart from its competitors. And, I’m sure Santa’s elves are able to transfer Mom or Dad to a service representative if the topic of a credit card to pay for all of those toys comes up in conversation.

“When we learned that the children in our town would miss out on meeting Santa Claus this year, we were crushed—and determined to find a way to help,” said James Johnson, CEO of PCSB Bank. “We’re thrilled to bring some merriness and cheer to all the people we know and love in this great community.”

How can you use POPi/o video banking to spread good cheer? Drop your ideas in the comments section below.