One of the most fascinating things about Minnesota is the infrastructure. It’s a state that was built to thrive in the cold. In the major city of Minneapolis, for example, there are nearly 10 miles of enclosed pedestrian footbridges. Referred to as the Minneapolis Skyway System, the elevated bridges and tunnels connect 80 full city blocks, giving people access to numerous downtown destinations, free of exposure to the often frigid weather.

This type of industrious, connective thinking and planning seems to be built in to the mindset of many Minnesotans. They understand the importance of staying connected despite circumstances and environmental factors. For that reason, it shouldn’t come as a surprise that Minnesota is a place where video banking has not only been adopted, but embraced.

“We felt like it just really opened up the capabilities for our membership.”

If you went to Minnesota and visited one of Affinity Plus Federal Credit Union’s 28 locations, you’d find a robust yet humble financial institution. Their locations are concentrated in the Minneapolis and St. Paul areas, but their footprint has increased in recent years. They’ve grown to serve smaller, more disparate communities in the far reaches of the state.

Likewise, their assets have grown as well. At over $3 billion—and having grown from $2.4 billion just in the last year—Affinity Plus manages a significant amount of assets. But as a not-for-profit, member-owned cooperative, Affinity Plus isn’t only focused on their asset size. Their main focus is serving their 220,000 members. In their own words, they’re committed to “improving the lives of [their] members through meaningful banking, exceptional experiences, and trusted relationships.”

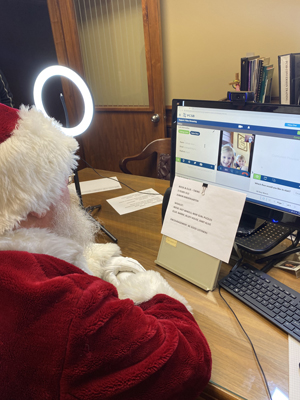

With the shuttering of branches during the COVID-19 pandemic, delivering on these key goals became difficult for Affinity Plus. But like a bridge built to connect people in a blizzard, the Minnesota credit union decided to use the adversity as an opportunity to improve their member experience. It was time for them to make the jump to video banking.

“We’ve been able to do everything that we do in a branch through video banking.”

“We started looking at it pre-pandemic,” said Jenny Nubeck, director of the Affinity Plus digital branch. “We felt like it just really opened up the capabilities for our membership.” Corey Rupp, Senior Vice President of Lending, shared the sentiment. He said the pandemic hastened their launch of video banking channels, but that it wasn’t the sole motivator leading up to it. Affinity Plus was already looking for ways to better serve their members and keep them connected—no matter where they were.

When asked how willing their members were to try the new service, Nubuck said she was surprised. Adoption of the video banking channels was higher than she’d expected. “It’s surprisingly simple,” she stated. “Based on everything we’re hearing from members, they’re like, ‘Ok, don’t let this service go away.’”

According to Rupp, the willingness to adopt is tied not only to the platform’s ease of use, but also to its versatility and functionality. “We’ve been able to do everything that we do in a branch through video banking,” Rupp said. “It’s been a great experience.”

“POPi/o has allowed Affinity Plus to see members again.”

Samantha Prudhon Falkowski, a member advisor at Affinity Plus, also commented on POPi/o’s functionality. Falkowski says she generates three to four loans per week through the video banking channel. And more importantly, she takes the video calls as a chance to discuss and compare options with members. By conversing face-to-face, Falkowski can get a sense of what the member is looking for, allowing her to best advise them. “The majority of calls that I’m seeing through video banking are people who want to have that in-depth conversation about ‘What’s the best recommendation?”

By taking video calls and fielding members’ questions, Falkowski gets to restore the personal connection she shared with members before the pandemic. As she puts it, “POPi/o has allowed Affinity Plus to see members again—to see them in their own spaces, and to help them with their banking needs.”

To learn more about the adoption of video banking by Affinity Plus, watch the video case study.

PCSB Bank

PCSB Bank