Since beginning our partnership with Abe.ai, creator of the Virtual Financial Assistant (VFA), we’ve been touching on this unique solution in our communications. But we’ve never really taken the opportunity to give a comprehensive look at what exactly a VFA does, and how financial institutions could wield it to their advantage—especially when used in conjunction with POPi/o’s Digital Communications solutions.

Who is Abe.ai?

Founded in 2016 and later acquired by Envestnet | Yodlee, Abe.ai is an artificial intelligence company that’s focused on building virtual assistant products and infrastructure for the financial services industry. Banks and credit unions of all sizes use Abe.ai’s software to create AI-powered, human-like experiences to scale customer support teams and enhance the customer experience.

What a VFA Could do for You

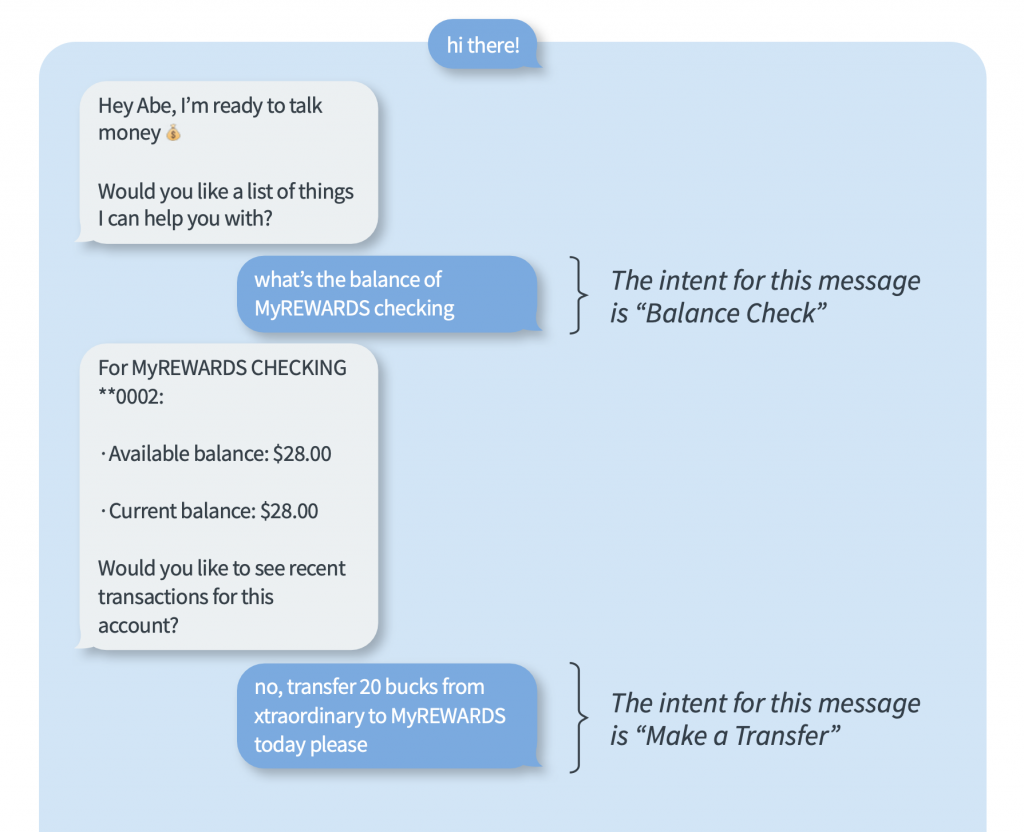

By interacting with consumers in the channels they prefer—such as website, online banking or mobile app—Abe.ai’s VFA plays the essential role of easing the load on customer service teams. Powered by machine learning and natural language processing, the VFA can interact in a natural and conversational way, resolving many common customer inquiries, freeing up call centers to use POPi/o’s Digital Communications solutions on more in-depth customer needs. With the ability to recognize thousands of utterances related to the most commonly asked questions at financial institutions, a VFA delivers a considerable amount of value to the customer experience. With a friendly, personable tone and rapid responses, it can field issues as they arise.

Some examples of inquiries that the VFA can assist with are:

“I can’t remember my password.”

“What are my branch hours?”

“What’s my routing number?”

“Where’s the nearest ATM?”

“Debit card shipping time?”

“When will my deposit clear?”

“I’m locked out of my account.”

Digital Tools With a Personal Touch

Allowing a VFA to interact with customers on behalf of your institution takes a certain level of trust. It’s important that the software meets customer needs and effectively responds to questions. But it’s equally important that your customers are willing to engage with the VFA in the first place. Making the technology approachable to the common user may seem like a tall order, but the VFA comes pre-trained right off the shelf, making it fast and easy to implement. To make the technology more engaging, financial institutions can do things like give the VFA its own name and profile image. This helps assure that the VFA comes off as friendly and approachable, and also creates an opportunity to brand it as your own. By designing a user experience that feels natural to customers, you build rapport and brand loyalty.

Looking to the Future

Looking to the Future

Because conversational AI is a technology that continues to evolve over time, a VFA is a solution that constantly improves, providing greater value as machine learning continues to enhance its responses. And when matched with POPi/o’s Digital Communications solution, you can leverage the most convenient and comprehensive digital tools in the financial services industry. Commonly asked “nuisance questions” can be resolved without the interruption of your customer-facing staff, and more involved customer inquiries and transactions can be resolved using POPi/o’s extensive digital tools, like collaborative video, cobrowse, and more. With a Digital Communications solution, you can provide digital services that are not only fast and convenient, but friendly and personalized as well.

Are you interested in learning more about easing the load on your call centers, preventing abandonment, and meeting customer needs as they arise? Let’s talk.